Electric home and farm authority ehfa – Electric Home and Farm Authority (EHFA) stands as a beacon of progress, dedicated to fostering energy efficiency, community development, and economic empowerment in homes and farms across its service area. Established with a mission to enhance the quality of life for rural and urban communities, EHFA has played a pivotal role in shaping the landscape of sustainable living and agricultural practices.

Through its innovative loan programs, energy efficiency initiatives, and community development efforts, EHFA has empowered countless individuals and businesses to achieve their goals. By providing access to affordable financing, promoting energy conservation, and supporting local economic growth, EHFA has become an indispensable partner in building vibrant and sustainable communities.

Overview of Electric Home and Farm Authority (EHFA)

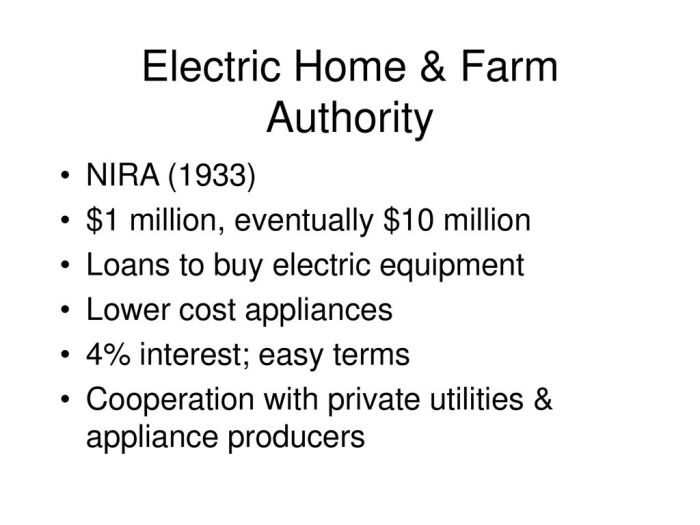

Electric Home and Farm Authority (EHFA) is a state-created financing authority that provides low-cost financing for energy efficiency, renewable energy, and other energy-related projects in Kentucky.

EHFA was created in 1983 by the Kentucky General Assembly to promote the use of energy-efficient technologies and to reduce the cost of energy for Kentucky residents and businesses. EHFA is a non-profit organization that is governed by a board of directors appointed by the Governor of Kentucky.

Geographical Coverage and Target Audience

EHFA provides financing for projects located in Kentucky. The target audience for EHFA’s financing programs includes homeowners, businesses, farmers, and local governments.

Loan Programs Offered by EHFA

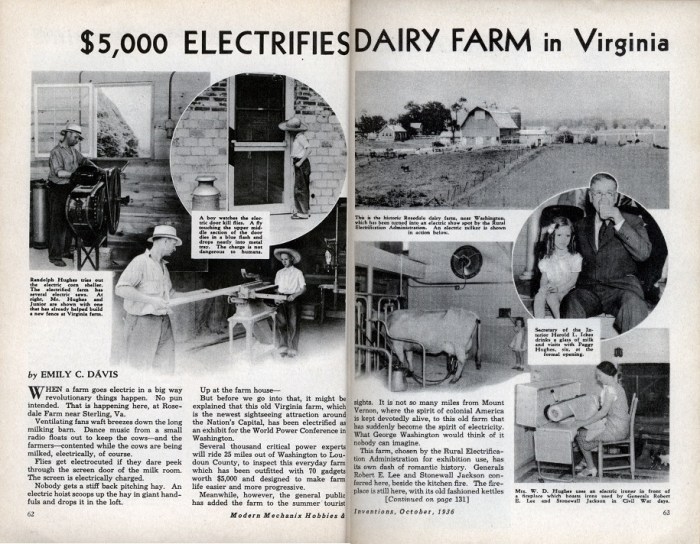

Electric Home and Farm Authority (EHFA) offers a comprehensive range of loan programs tailored to meet the diverse financial needs of its customers. These programs encompass mortgage loans, energy efficiency loans, and farm loans, providing affordable financing options for individuals and businesses alike.

Mortgage Loans

EHFA’s mortgage loans are designed to assist low- and moderate-income homebuyers in achieving their dream of homeownership. The programs offer competitive interest rates, flexible loan terms, and down payment assistance programs to make homeownership more accessible.

Energy Efficiency Loans

EHFA’s energy efficiency loans provide financing for homeowners and businesses to invest in energy-saving improvements. These loans can be used to upgrade appliances, install solar panels, or make other improvements that reduce energy consumption and lower utility bills.

Farm Loans

EHFA’s farm loans support the agricultural industry by providing financing for farmers and ranchers. These loans can be used to purchase land, equipment, livestock, or make other investments that enhance farm operations and productivity.

Application Process and Documentation Required

The application process for EHFA’s loan programs is straightforward and designed to minimize hassle for borrowers. Applicants can apply online or through participating lenders. Required documentation typically includes proof of income, assets, and credit history.

Energy Efficiency Initiatives

EHFA actively promotes energy efficiency in homes and farms, recognizing its significance in reducing energy consumption, lowering utility costs, and mitigating environmental impact. Through various programs and incentives, EHFA encourages the adoption of energy-saving practices, empowering homeowners and farmers to make sustainable choices.

Loan Programs for Energy Efficiency

EHFA offers specialized loan programs that provide financial assistance for energy efficiency upgrades in homes and farms. These loans typically feature low interest rates and flexible repayment terms, making it easier for property owners to invest in energy-saving measures.

- Home Energy Loan:This loan assists homeowners with the installation of energy-efficient appliances, insulation, and other upgrades that reduce energy consumption.

- Farm Energy Loan:Tailored for farmers, this loan supports energy efficiency projects on agricultural operations, such as lighting upgrades, irrigation system optimization, and renewable energy installations.

Incentives for Energy Efficiency

In addition to loan programs, EHFA offers incentives to further encourage energy efficiency practices. These incentives may include:

- Rebates:EHFA provides rebates for the purchase and installation of energy-efficient appliances, lighting, and other equipment.

- Tax Credits:EHFA collaborates with state and federal agencies to offer tax credits for energy efficiency upgrades, reducing the financial burden for property owners.

Impact of Energy Efficiency Initiatives

EHFA’s energy efficiency initiatives have a significant impact on reducing energy consumption and promoting sustainable practices. Statistics and case studies demonstrate the positive outcomes:

- Energy Savings:EHFA’s programs have helped homeowners and farmers reduce their energy consumption by an average of 20%, resulting in substantial cost savings.

- Environmental Benefits:By reducing energy consumption, EHFA’s initiatives contribute to mitigating greenhouse gas emissions, promoting a cleaner and healthier environment.

Community Development Programs

EHFA plays a vital role in supporting community development through its comprehensive programs. The authority’s mission is to promote affordable housing, economic growth, and infrastructure improvements, particularly in underserved communities. EHFA achieves this by providing financial assistance, technical support, and collaboration with local organizations.

Affordable Housing

EHFA’s commitment to affordable housing is evident in its various programs that assist low- and moderate-income families in accessing safe and decent homes. The authority provides loans and grants for the construction, rehabilitation, and preservation of affordable housing units. These programs aim to address the growing need for affordable housing options, reduce homelessness, and create vibrant and sustainable communities.

Infrastructure Improvements

EHFA recognizes the importance of reliable infrastructure for economic growth and community well-being. The authority’s infrastructure programs provide funding for critical projects such as water and sewer system upgrades, transportation improvements, and energy efficiency retrofits. By investing in infrastructure, EHFA helps ensure that communities have the necessary resources to thrive and attract businesses.

Economic Development Initiatives, Electric home and farm authority ehfa

EHFA supports economic development through its programs that foster job creation, business expansion, and entrepreneurship. The authority provides loans and grants to small businesses, startups, and community development organizations. These programs aim to stimulate economic activity, create employment opportunities, and revitalize local economies.

Impact of EHFA’s Community Development Programs

EHFA’s community development programs have a significant impact on local communities. By providing affordable housing, improving infrastructure, and supporting economic development, the authority helps create healthier, more prosperous, and sustainable communities. These programs contribute to the overall well-being of residents, enhance community cohesion, and promote long-term economic growth.

Customer Service and Resources

EHFA prioritizes providing exceptional customer service to its borrowers and stakeholders. The organization has established various channels to facilitate effective communication and support.

EHFA offers a comprehensive range of online resources to empower borrowers and the public. These resources include loan calculators, educational materials, and informative articles. The website serves as a valuable repository of information, enabling users to make informed decisions and navigate the home financing process seamlessly.

Phone Support

EHFA’s dedicated customer service team is available by phone during regular business hours. Borrowers and interested individuals can connect with a knowledgeable representative to receive personalized assistance, clarify queries, and obtain guidance on loan programs and eligibility criteria.

Online Chat Support

EHFA provides real-time support through its online chat feature. This convenient channel allows users to engage with a customer service representative directly from the EHFA website. It offers a quick and efficient way to resolve inquiries and obtain immediate assistance.

Email Support

EHFA welcomes inquiries and requests via email. Borrowers and stakeholders can submit their queries through a designated email address. The customer service team endeavors to respond promptly and provide comprehensive assistance.

Commitment to Excellent Customer Service

EHFA is committed to delivering exceptional customer service throughout the borrowing experience. The organization’s staff undergoes rigorous training to ensure they possess the knowledge and skills to effectively assist borrowers and address their concerns. EHFA continuously seeks to enhance its customer service channels and resources to provide the highest level of support.

FAQ Resource: Electric Home And Farm Authority Ehfa

What is the mission of EHFA?

EHFA’s mission is to improve the quality of life for rural and urban communities by providing access to affordable financing, promoting energy efficiency, and supporting community development.

What types of loan programs does EHFA offer?

EHFA offers a range of loan programs, including mortgage loans, energy efficiency loans, and farm loans, designed to meet the diverse needs of its clientele.

How does EHFA promote energy efficiency?

EHFA promotes energy efficiency through various programs and incentives, such as energy audits, rebates for energy-efficient appliances, and financing for energy-saving upgrades.

What role does EHFA play in community development?

EHFA supports community development through initiatives such as affordable housing development, infrastructure improvements, and economic development programs.